I. Taxes Related with an Employment

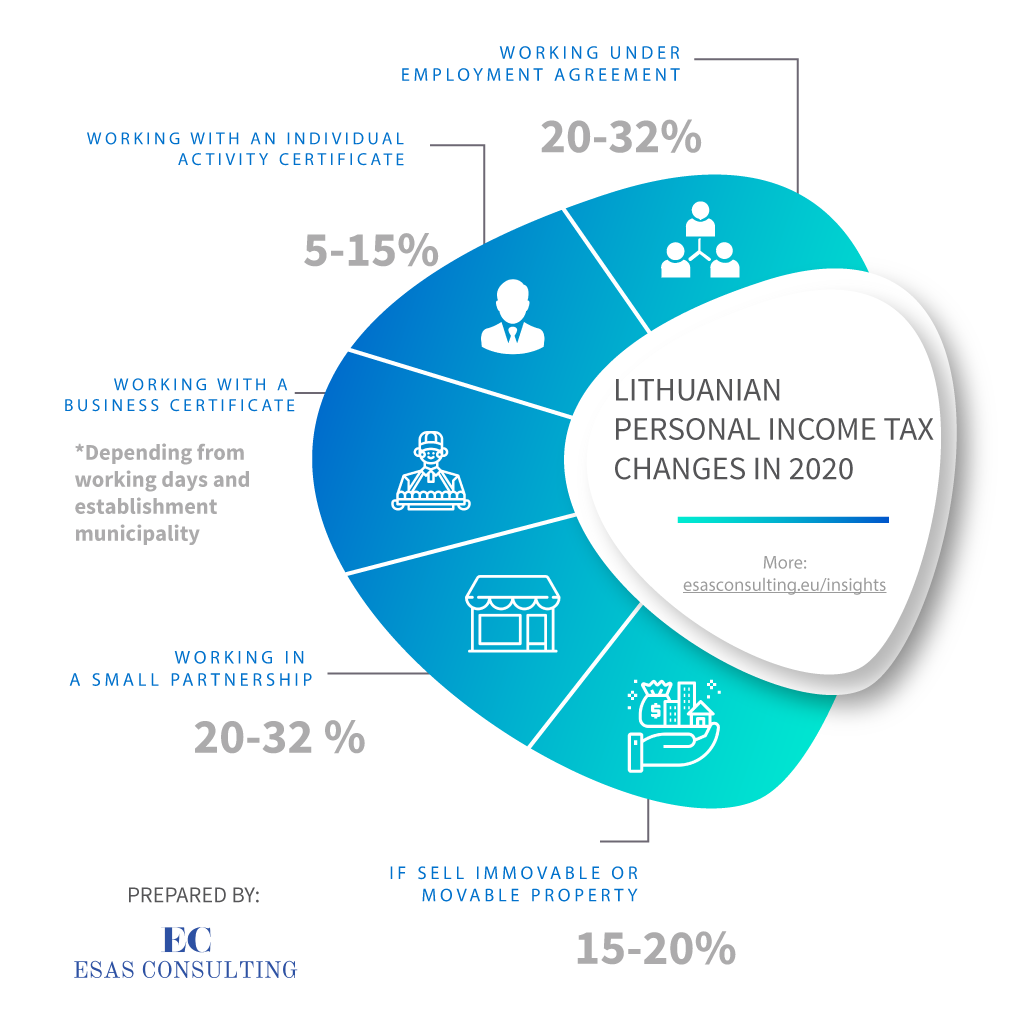

Employment-related income in Lithuania derived by individuals generally is subject to the personal income tax (PIT) at the rate of:

| 20% | If annual income ≤EUR 104 277,60 |

| 32% | If annual income >EUR 104 277,60 |

| 15% | Income earned in 2018 or earlier |

We remind you that monthly minimal wage in Lithuania at 2020 is EUR 607 (bruto). About increased minimal wage we wrote here (in lithuanian).

II. Other Income Not Related with an Employment

Personal income tax rate applicable to income received in 2020:

| 15% | Dividends |

| 15% if annual income ≤EUR 148 968 20% if annual income >EUR 148 968 | – Royalties – Income from the sale (or other transfer) of property – Property rent income – Fees – Gambling prizes |

| 5-15% | Individual activities income (calculator) |

| Fixed Tax | Business certificate income (calculator) |

III. Deductions and Allowances

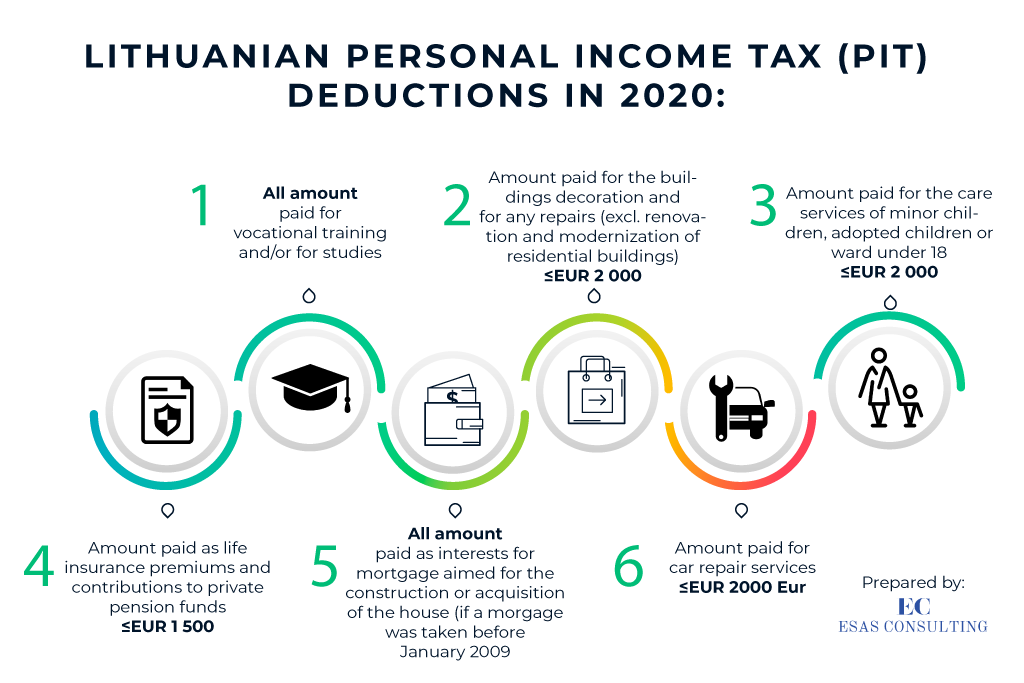

Personal income tax rate in 2020 can be reduced by:

| 1 | NPD EUR 350, if monthly income ≤EUR 607 NPD EUR 0, if monthly income >EUR 2 666 | Monthly tax-exempt amount of income (NPD) |

| 2 | From income can be deducted ≤EUR 1 500 | paid as life insurance premiums and contributions to private pension funds |

| 3 | All sum | paid for vocational training and/or for studies |

| 4 | All sum | paid as interests for one mortgage aimed for the construction or acquisition of the house (if an agreement was concluded before 1st of January 2009). |

| 5 | From income can be deducted ≤EUR 2 000 | expenses on buildings decoration and for any repairs (excl. renovation and modernization of residential buildings) |

| 6 | From income can be deducted ≤EUR 2 000 | expenses on car repair services |

| 7 | From income can be deducted: ≤2 000 Eur | expenses on care services for minor children (adopted children or ward) under 18 years old |

IV. PIT Payment

A person who received income must submit the personal income tax return until the 1st of May of the next tax period. A person should declare income and pay tax himself or through a representative.