Contents

According to the taxfoundation.org, Lithuania has 3rd lowest company income tax in Europe.

I. Company income tax in Lithuania

Generally, Company Income Tax (CIT) is applied on taxable income received by the company incorporated in Lithuania from its local and worldwide activities. Taxable income is calculated by reducing the general income of a certain tax period with deductible expenses and non-taxable income.

Non-resident companies are generally taxed on Lithuania-sourced income received through a local permanent establishment (PE) and reduced by deductible expenses or on income subject to WHT in Lithuania.

The general company income tax rate in Lithuania is 15%. Micro companies (those with up to an average of 10 employees and annual income not exceeding EUR 300 000) may be exempt from tax for the first tax period and entitled to a reduced rate of 5% for subsequent tax periods.

Income earned from the commercialization of scientific research and experimental development (R&D) production is subject to a reduced rate of 5%.

As of 2020, the companies incorporated in Lithuanian free economic zones (FEZ) are exempt from corporate income tax for 10 taxable periods and are subject to 50% of the standard corporate income tax rate in subsequent 6 periods. In short, this gives a substantial advantage to the company for 16 consecutive tax periods. Trade activities do not qualify for the incentive.

The relief requires an investment of at least EUR 1 million by a FEZ company. An alternative exists for FEZ companies rendering services – an investment of at least EUR 100 000, but an average minimum of 20 employees. At least 75% of the company’s income during a taxable year must be derived from the activities carried out in a FEZ. Exemption from real estate tax applies in a FEZ.

There is no local or municipal CIT in Lithuania.

II. Dividends

Dividends are taxable at a rate of 15% unless the below-detailed participation exemption applies.

Dividends paid to foreign or Lithuanian companies are not subject to WHT if the recipient has held at least 10% of voting shares of the paying company for a continuous period of at least 12 successive months. This relief does not apply if the recipient of dividends is registered in blacklisted territories.

Dividends received from a foreign entity registered in the European Economic Area (EEA) member state and whose profits are subject to CIT or an equivalent tax are exempt from WHT tax. Dividends received from a foreign entity registered in a state other than an EEA member state also may be tax-exempt if the Lithuanian company holds at least 10% of the shares of the subsidiary for at least 12 months, the foreign entity’s profits are subject to corporate income tax or an equivalent tax and the foreign entity is not registered in a blacklisted territory.

III. Capital gains

Capital gains of resident and non-resident companies are taxed as general taxable income, at a rate of 15%.

Capital gains are non-taxable if they are derived from the transfer of shares of an entity that is registered in Lithuania or another EEA country, or in a country with which Lithuania has a double taxation treaty (DTT) and is subject to CIT or equivalent tax.

To qualify for the exemption, the Lithuanian company or foreign company PE must hold more than 10% of the voting rights for an uninterrupted period of at least 2 years. In case of a reorganization, the exemption applies if a company or foreign company PE has held more than 10% of the voting rights for an uninterrupted period of at least 3 years.

IV. Interests

Interest paid by Lithuanian company to a foreign company established in the EEA area or in countries with which Lithuania has a DTT is not subject to WHT in Lithuania. Otherwise, interest sourced in Lithuania and received by a foreign company is generally subject to WHT at a rate of 10%.

V. Royalties

Royalties paid to the qualifying related parties (parties are deemed to be related if one of them holds directly at least 25% of the capital of the other, or a third EU company holds directly at least 25% of the capital of these two companies), EU tax residents, are not subject to WHT in Lithuania. Otherwise, royalties sourced in Lithuania and received by a foreign company are generally subject to WHT at a rate of 10%.

VI. Social security contributions

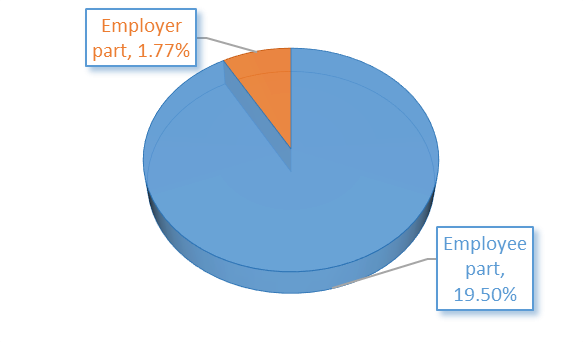

Income arose from employment is subject to social security contributions (SSC) at a rate of 12,52% of the employee’s brutto salary and 6,98% for health insurance contributions (the employee’s portion). Also, an additional 1.8% or 3% can be paid by employees who voluntarily participating in II pillar pension accumulation plans.

The employer’s portion is equal to 1,77% (2.49% for temporary employment contracts).

Whereas an income received from an appointment to a management board, supervisory board or loan comitee is subject to 6,98% health insurance contributions (plus 1,8% or 3% if person participates in II pillar pension plan) and 8,72% SSC contribution.

This Lithuanian Corporate Taxation overview can be downloaded in here.

If you would like to receive more sophisticated consultation about company taxation in Lithuania, please do not hesitate to contact us.